It might be difficult to navigate the payment processing industry as a high-risk company owner. Businesses that fit into high-risk categories are often met with resistance by banks and other financial service providers. Nonetheless, Authorize.net provides high-risk businesses with a dependable and secure payment gateway. The reasons Authorize.net is a secure option for payment processing are examined in this article.

Strong Gateway Functions

Businesses may safely handle online purchases with authorize.net safe, a complete payment gateway solution. Following a customer’s purchase, the gateway carries out a number of essential tasks to guarantee the quick and safe completion of card-not-present transactions. With capabilities like fraud detection, invoicing, and recurring billing, Authorize.net assists companies in keeping a positive cash flow while handling client payments with ease.

Process for Secure Transactions

The encryption of sensitive data is the first step towards the security of transactions handled by Authorize.net. On the merchant’s website, customers submit their payment information. This information is encrypted and then safely sent to Authorize.net. Cutting-edge encryption techniques protect credit card information while it’s being sent, greatly lowering the possibility of unwanted access. Authorize.net is used to transmit the outcome back to the payment processor and issuing bank once they have validated the transaction information. This ensures that denials and approvals are handled securely.

Advanced Security Against Fraud

The sophisticated fraud detection systems offered by Authorize.net are among its best features. These programs scan transactions for indications of fraud, such questionable sources or out-of-the-ordinary transaction quantities, using thirteen distinct criteria. By taking a proactive stance, companies may reduce the likelihood of fraud and chargebacks, safeguarding their income and brand. High-risk organizations may better limit their exposure to financial hazards by using these protections.

Observance of Security Guidelines

For Authorize.net, security is paramount. The Payment Card Industry Data Security Standards (PCI DSS), which specify extensive security protocols for payment processing, are complied with by the gateway. By upholding these strict guidelines, Authorize.net reassures consumers that they are transacting in a secure environment and further establishes its reputation as a reliable option for high-risk companies who are worried about data security.

Simplified Payment Processing

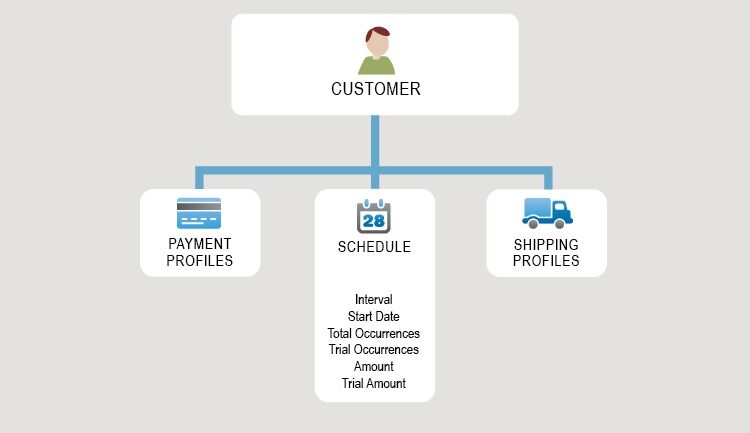

Authorize.net not only provides improved security measures but also easy-to-use payment management solutions. With the help of the recurring billing tool, companies may automate client billing cycles and guarantee on-time payments with no need for human participation. Additionally, with the ability to invoice clients directly, retailers may expedite the collection process by offering a simple and safe payment link. These features increase client happiness while assisting firms in managing their cash flow better.

A Reliable Adviser for Businesses at High Risk

Authorize.net is a great option for high-risk companies having trouble with payment processing. With higher acceptance rates, improved security features, and customized services designed to fit the particular requirements of high-risk sectors, Authorize.net gives consumers and company owners alike confidence.